Strategies to Maximize Rewards and Benefits in Credit Cards

Understanding Credit Card Rewards

Credit cards have become an essential financial tool in today’s consumer marketplace. Not only do they provide a convenient payment method, but when used strategically, they can offer a range of benefits that enhance your purchasing power. To make the most of these advantages, it’s crucial to understand the specifics of credit card rewards.

Types of Rewards

When choosing a credit card, it’s essential to evaluate the different types of rewards programs available. For instance, cash back credit cards return a percentage of your purchases as cash, which can be applied as a statement credit or a direct deposit into your bank account. An example is the Citi Double Cash Card, which offers 2% cash back on all purchases—1% when you buy and 1% when you pay off your balance.

Alternatively, travel rewards credit cards allow you to accumulate points or miles that can be redeemed for flights, hotel stays, or travel-related expenses. Popular options include the Chase Sapphire Preferred, which offers points that can be transferred to various airline and hotel partners, significantly boosting their value.

Lastly, many cards offer retail discounts or specific perks at partnering stores. Store-branded credit cards, like those from Target or Walmart, often come with exclusive discounts and promotions that can lead to substantial savings when shopping at those retailers.

Sign-Up Bonuses

One attractive feature of credit cards is their sign-up bonuses. Upon meeting a minimum spending requirement within the initial months, you may receive significant rewards. For example, the American Express Gold Card offers a substantial bonus of Membership Rewards points after you spend a certain amount in the first three months. These points can be used for travel, dining, or even shopping.

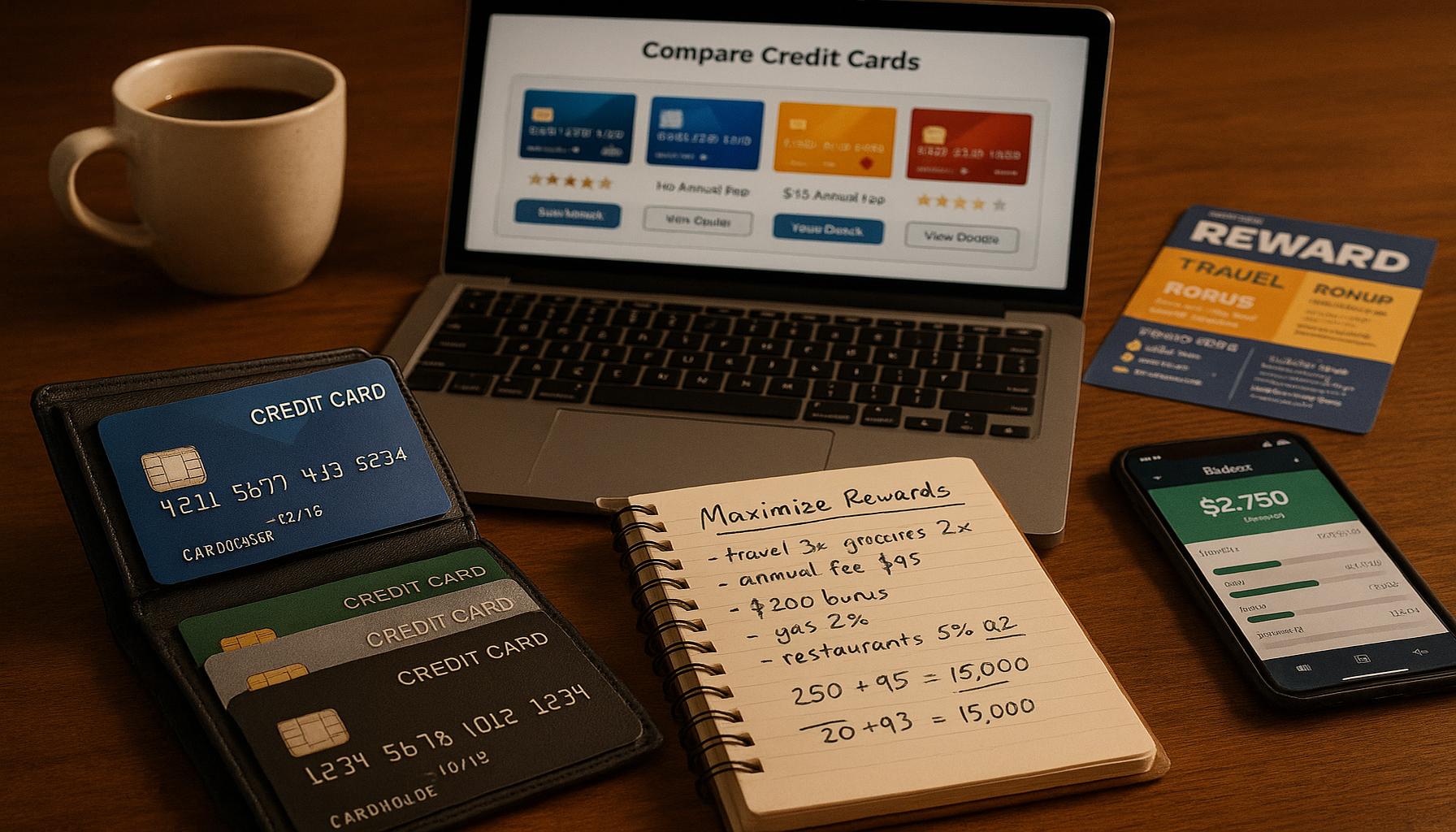

Strategies to Maximize Rewards

To truly benefit from your credit card, it’s important to adopt sound financial habits. For example, paying your balance in full every month is critical. Not only does this practice avoid accruing interest charges, which can wipe out the value of any rewards, but it also helps maintain a healthy credit score.

Taking advantage of bonus categories is another effective strategy. Many credit cards feature rotating categories each quarter or specific fixed categories where you can earn higher rewards. For instance, if your card offers 5% back on groceries from January to March, make sure to do your grocery shopping during that period to maximize your earnings.

Lastly, combining rewards programs across different credit cards can significantly amplify your benefits. For example, you might use a card that offers great rewards for dining out while using another card that gives high cash back on everyday purchases. This strategic approach allows you to maximize rewards across your spending habits.

By following these strategies and understanding your credit card’s rewards structure, you can transform routine expenses into valuable benefits. With informed choices, your spending can yield substantial rewards that enhance your financial well-being.

Strategies for Effective Credit Card Usage

Maximizing the rewards and benefits of your credit card requires a strategic approach that goes beyond simply using the card for routine purchases. Implementing smart practices can help amplify the advantages while keeping your financial health intact.

Understand Your Spending Habits

The first step in maximizing rewards is to analyze your spending habits. Knowing where and how you spend your money allows you to choose the right credit card that complements your lifestyle. For example, if you frequently dine out or travel, selecting a card that offers enhanced rewards in those categories will yield greater benefits. Here are a few common spending categories to consider:

- Groceries: If groceries make up a significant portion of your monthly expenses, look for cards offering high cash back or rewards points for grocery purchases.

- Dining: Frequent diners should consider cards that provide bonus points or cash back for restaurant purchases.

- Travel: If you often travel, opt for travel rewards cards that allow you to accumulate points or miles with every purchase, especially those made with airlines or hotels.

- Gas Stations: For those who drive often, cards with rewards tailored for gas purchases can lead to meaningful savings over time.

Utilize Tools and Apps

Many credit card companies offer tools and apps designed to help cardholders manage their accounts effectively. These may include expense tracking, alerts for due dates, and spending insights that can help you identify how to optimize rewards. Setting up reminders for payment deadlines can ensure you never miss a due date, preventing unwanted interest charges that can diminish the value of your rewards.

Leverage Annual Fees with Care

Some credit cards charge annual fees, but this doesn’t necessarily mean you shouldn’t choose them. Often, cards with annual fees offer greater rewards, enhanced benefits, or perks such as travel insurance. When evaluating a card with an annual fee, make sure to calculate whether the rewards and benefits will exceed the cost of the fee. If you travel frequently, for example, a card that offers complimentary airport lounge access or travel insurance may provide significant value that justifies the yearly cost.

By taking the time to understand your financial behavior and the rewards offered by your credit card, you will be better positioned to make choices that lead to increased rewards and overall benefits. Whether it is through analyzing your spending, utilizing available tools, or considering the value of annual fees, following these strategies can transform the way you use your credit card into a rewarding financial experience.

Making the Most of Promotions and Bonuses

Credit card companies frequently offer promotional bonuses that can significantly boost your rewards. These promotions might include initial sign-up bonuses, limited-time offers, or referral bonuses for bringing in new customers. Taking advantage of these promotions can provide substantial rewards without altering your regular spending.

Initial Sign-Up Bonuses

Many credit cards entice new customers with attractive sign-up bonuses, which can include cash back, points, or miles after you spend a certain amount within the first few months. For instance, a card may offer a bonus of 50,000 points if you spend $3,000 in the first three months of account opening. Understanding and planning on how you can meet these spending requirements without exceeding your budget is crucial. You might consider structuring your purchases around fixed expenses, such as bills or necessary shopping, to quickly reach the bonus threshold.

Maximizing Rewards Categories

Credit cards often have different reward categories that vary by quarter or month. Make sure to familiarize yourself with these categories and adjust your spending accordingly. For example, if your card provides 5% cash back on purchases at grocery stores for a particular quarter, aim to do your grocery shopping during this promotional period to maximize your earnings. Staying informed about the calendar of rotating categories will allow you to plan your purchases strategically and increase your rewards potential.

Utilizing Loyalty Programs

Many credit cards have partnerships with airlines, hotels, or retail chains that allow you to combine rewards. Enroll in these loyalty programs to earn additional points or cash back when using your card for purchases. A travel rewards card might provide extra miles when booking flights or hotels with affiliated partners, amplifying the value of your regular spending. In some cases, you can even transfer your credit card points to a partner loyalty program, giving you access to premium seats or exclusive deals.

Paying Attention to Redemption Options

Understanding the redemption options available for your credit card rewards is essential to maximizing their value. Some cards offer more favorable conversion rates for cash back versus points or miles. Additionally, certain spending categories may yield more reward points when redeemed for specific purposes, such as travel versus merchandise. Evaluating these choices will help you determine the best way to utilize your earned rewards. For example, using points for travel expenses, often provides a higher value compared to using them for merchandise purchases at retail.

Maintaining an Optimal Credit Utilization Ratio

Alongside maximizing rewards, it is vital to consider your credit utilization ratio, which is the percentage of your credit limit that you use. Keeping your utilization below 30% is recommended for maintaining a healthy credit score. This not only supports your creditworthiness but may help you qualify for cards with better rewards in the future. If your target is to earn significant rewards, utilizing a few cards for different purchases while maintaining low balances can provide a pathway to increased benefits.

By leveraging these strategies, from utilizing promotional offers to understanding reward redemption options and maintaining healthy credit utilization, cardholders can significantly enhance the rewards and benefits they receive from their credit cards. Each of these strategies works in unison to ensure that you get the most out of every dollar spent while supporting your overall financial well-being.

Conclusion

In summary, effectively maximizing rewards and benefits from credit cards requires a combination of strategic planning, informed choices, and awareness of available offers. By taking advantage of promotional bonuses and understanding how to meet their spending requirements, you can quickly earn substantial rewards without overspending. Additionally, staying current with rewards categories and planning your purchases around them can significantly amplify your earning potential.

Engaging with loyalty programs allows you to further enhance your rewards, creating a synergy between your credit card and your favorite brands. Choosing the right redemption options is equally important; understanding how your points translate into real-world value can lead to more favorable outcomes, especially when redeeming for travel versus merchandise. Finally, maintaining a healthy credit utilization ratio protects your credit score and positions you to qualify for cards that offer superior rewards.

By integrating these strategies into your financial habits, you can transform your everyday spending into a rewarding experience. Whether it’s a family vacation, a shopping spree, or simply enhancing your financial stability, the benefits you reap from credit cards can add significant value to your life. Start implementing these tactics today, and watch your rewards grow as you enjoy the perks of being a savvy credit card user.

Related posts:

How to Apply for Choice Privileges Select Mastercard Credit Card Online

How to Apply for the USAA Advantage Credit Card Step-by-Step Guide

How to Apply for HSBC World Elite Mastercard Credit Card Today

How to Apply for the Luxury MasterCard Black Credit Card Step-by-Step Guide

How to Apply for the Capital One Spark Miles Credit Card Today

How to Apply for Discover It Cash Back Credit Card Simple Steps

James Carter is a financial writer and advisor with expertise in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, James offers practical insight and analysis. His goal is to give readers the knowledge they need to achieve financial success.