The Effects of Inflation on Family Budget and How to Adjust Your Finances

Understanding Inflation’s Impact on Your Family Budget

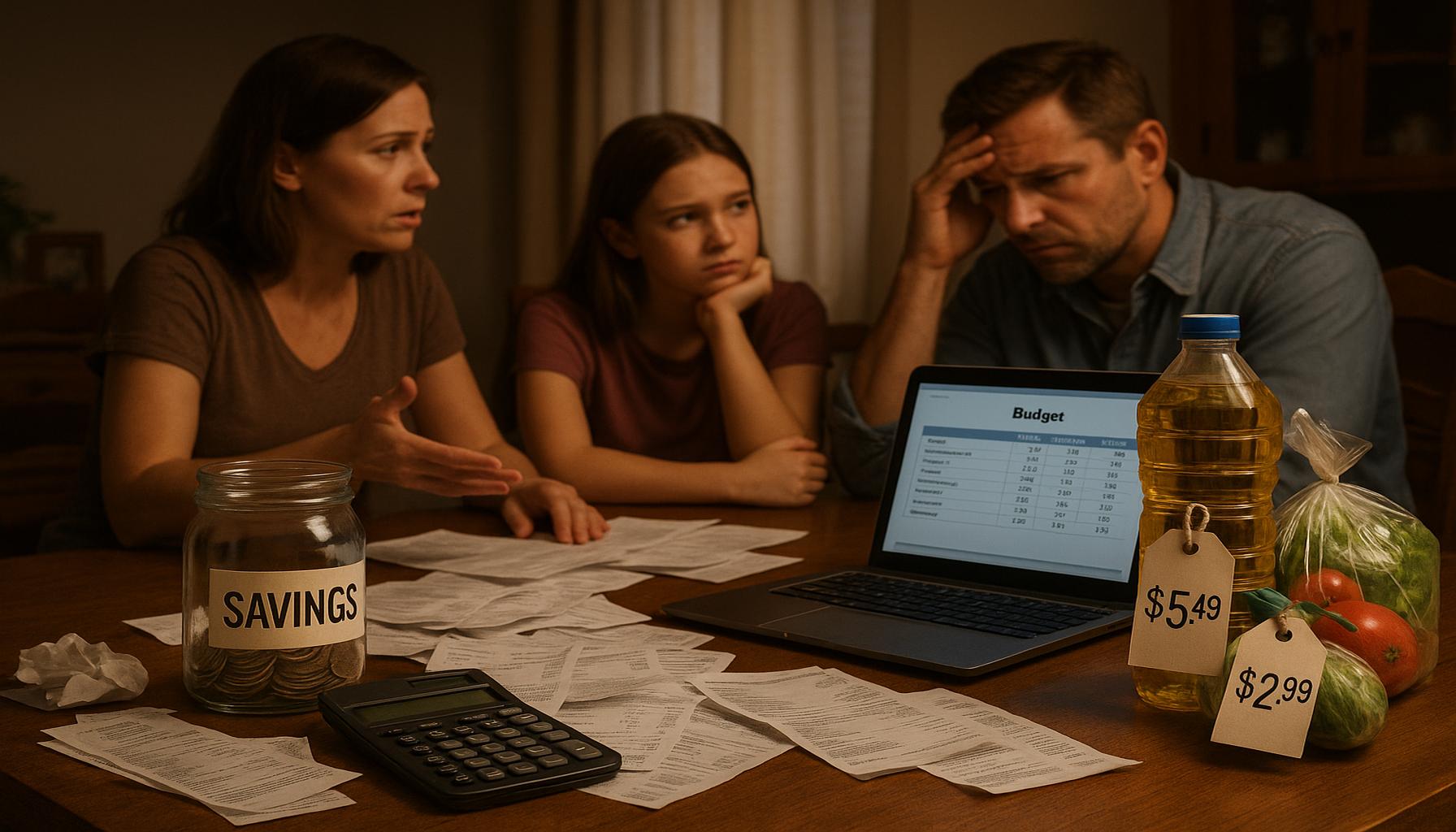

Inflation can be an invisible yet relentless force that impacts our daily lives. It subtly influences our purchasing decisions and ultimately makes it challenging to adhere to a carefully crafted family budget. As prices rise, it’s crucial to recognize the effects of inflation and adjust your financial strategies accordingly to reinforce your family’s financial stability.

One primary effect of inflation is the increased prices of essential goods and services. For example, the cost of everyday necessities like groceries, toiletries, and gas can fluctuate significantly. If milk was priced at $3 per gallon last year and rises to $3.50 this year, the increase adds up quickly, especially for families that rely on multiple gallons per week. This increase can limit how much you can purchase, forcing you to make more cost-conscious decisions.

Another important aspect is the decreased savings value. Imagine putting away $1,000 today; if inflation continues to rise at 4% annually, that same $1,000 could only buy what $960 would buy today within a year. This erosion of your savings highlights why it’s essential to think strategically about where you stash your funds. Options that offer higher returns than the inflation rate become increasingly important.

Higher interest rates are also a common consequence of inflation. When the economy heats up due to rising prices, central banks may increase interest rates to cool it down. If you have a mortgage or other loans, higher interest rates can mean increased monthly payments, placing further strain on your budget. For instance, a mortgage rate rising from 3% to 5% on a $300,000 loan significantly increases your monthly payment, making your home more expensive over time.

In light of these challenges, it’s essential to revise your financial strategies. One effective approach is to reassess your spending. Start by tracking your expenses for a month to identify where your money goes. Prioritize necessary expenses—like housing, utilities, and groceries—over discretionary spending, such as dining out or entertainment. This simple act of monitoring can illuminate areas where potential cuts can bolster your budget.

Additionally, creating an emergency fund can be a lifesaver as prices rise. Having three to six months’ worth of expenses in a savings account can provide a financial cushion against unexpected situations, like home repairs or medical expenses. This can also save you from resorting to high-interest credit cards when emergencies arise.

Lastly, consider investing wisely. Options like stocks, bonds, or real estate have historically outpaced inflation over the long term. For example, investing in real estate can not only provide rental income but also appreciates in value, making it a great hedge against inflation. If you have the capacity, even small contributions to investment accounts can grow significantly over time.

By understanding the effects of inflation and implementing these strategies, you can take steps to protect your family’s financial future, creating a budget that withstands the test of rising prices. In the following sections, we will explore these strategies in detail, equipping you with the knowledge you need to navigate inflation more effectively.

Recognizing the Effect of Inflation on Household Planning

To effectively navigate the challenges posed by inflation, it is essential to develop a clear understanding of how it interacts with your household finances. Beyond just the fluctuating price tags on grocery store shelves, inflation can affect your family’s financial landscape in several ways.

One of the most immediate consequences of inflation is the erosion of purchasing power. When inflation rises, the same amount of money buys fewer goods and services than before. For instance, if your monthly grocery budget was set at $500 last year, due to rising prices, you may find it falls short of covering your family’s essential needs this year. Thus, you’ll have to reassess how much you’re allocating to different categories in the budget.

Additionally, wage growth often fails to keep pace with inflation. If you receive a raise of 3% this year, but inflation is at 4%, you’re effectively losing ground financially. Your disposable income decreases as the cost of living increases, complicating your ability to save, invest, or spend on non-essential items. Understanding this disconnect between wage growth and inflation is crucial for maintaining financial health.

Another effect of inflation is seen in housing costs. Whether you rent or own your home, inflation can lead to increased rent prices or mortgage rates. If you’re renting, your landlord may raise your rent to keep up with inflation, leaving you with less disposable income. If you’re looking to buy a home, higher mortgage rates due to inflation can lead to increased monthly payments and affect your long-term budgeting. Recognizing these changes is vital for future planning.

To combat these inflation-related challenges, here are some strategies to enhance your financial planning:

- Reevaluate Your Budget: Take the time to reassess your spending categories. Start by reviewing your past two to three months of expenses and identify any areas where you can cut back.

- Prioritize Necessities: Focus on allocating your budget towards non-negotiable expenses such as housing, utilities, groceries, and transportation. Keep discretionary spending on items like entertainment or dining out to a minimum.

- Increase Income Streams: Consider exploring side gigs or additional part-time work. Even small amounts of extra income can make a significant difference in your budget.

- Stay Informed: Regularly monitor economic indicators and be aware of changes in inflation rates. This will allow you to make informed decisions as you plan your budget.

By being proactive and adopting these strategies, you can effectively manage your family budget amidst the pressures of inflation. In the next sections, we will delve deeper into innovative ways to bolster your finances and thrive despite rising costs.

Adapting Your Finances to a Changing Economic Landscape

As inflation continues to impact family budgets, it’s crucial to implement practical adjustments that can help mitigate its effects on your finances. One of the first steps in this adaptation process is understanding fixed versus variable expenses. Fixed expenses, such as mortgage or rent, car payments, and insurance, remain constant over time. In contrast, variable expenses—like groceries, utilities, and entertainment—can fluctuate month to month. By analyzing your budget, you can identify which costs are fixed and which can be adjusted to better align with current inflation trends.

One effective approach to managing variable expenses is the creation of a shared household spending plan. Involving family members in budgeting discussions fosters an environment of collaboration and ensures everyone is on the same page regarding financial planning. For example, you might decide to set a family-wide goal to limit dining out to once a week, redirecting those savings to other needs or savings accounts. This not only helps curb unnecessary spending but also places accountability on all members of the household.

Another useful financial adjustment involves prioritizing savings and investments. With inflation eroding purchasing power, it is essential to have an emergency fund that can help you cover unforeseen expenses without resorting to high-interest debt. Aim to set aside at least three to six months’ worth of living expenses in a high-yield savings account. Additionally, consider bolstering your investment portfolio with assets that typically perform well in inflationary environments, such as real estate or inflation-protected securities like TIPS (Treasury Inflation-Protected Securities).

Incorporating flexible spending techniques can also shield your family from inflation’s impact. Utilizing cash-back rewards programs or tracking deals and discounts can lead to significant savings over time. For instance, many grocery stores offer loyalty programs that provide discounts on everyday items or special promotions. By taking advantage of these opportunities, you can stretch your budget further without compromising on essentials.

When considering larger purchases, especially in times of rising prices, it’s advisable to embrace a wait-and-see approach. For instance, before committing to buying a new car or furniture, conduct thorough research and track prices over a few weeks or months. This practice allows you to identify potential sales or discounts, ensuring you’re not overpaying for essential items.

Lastly, don’t underestimate the value of financial education. Staying informed about personal finance topics, including inflation and market trends, equips you with the knowledge needed to make better financial decisions. Utilize reputable online resources, attend local workshops, or even consider consulting with a financial advisor to tailor your strategies to your unique family situation.

By thoughtfully reevaluating spending habits, prioritizing savings, and seeking out educational resources, you can create a financial strategy that enhances resilience against inflation while ensuring that your family’s needs are met. Adjusting your financial approach is not just about enduring inflation but thriving despite it.

Conclusion

In conclusion, navigating the realities of inflation requires a proactive and informed approach to your family budget. Recognizing the difference between fixed and variable expenses is paramount; it allows families to quickly identify where adjustments can be made without sacrificing essential needs. Developing a shared household spending plan fosters collaboration among family members, ensuring that everyone understands the importance of financial responsibility during challenging economic times.

It’s essential to emphasize the necessity of building and maintaining an emergency fund. A well-prepared family will not only guard against unexpected expenses but also preserve peace of mind, knowing they have financial security amidst rising costs. Investing in assets that can buffer against inflation, such as real estate or certain stocks, can also provide long-term financial stability.

Moreover, the adoption of flexible spending techniques can significantly enhance your family’s budget management. By taking advantage of promotions, rewards programs, and engaging in a wait-and-see approach for larger purchases, families can make more informed decisions that help keep their finances intact. Lastly, prioritizing financial education will empower family members to adapt to financial changes competently, equipping them with the skills needed to make wise financial choices.

Ultimately, by reevaluating spending habits and prioritizing strategic adjustments, families can not only withstand the pressures of inflation but can also ensure that their financial health continues to thrive in an ever-changing economic landscape.

Related posts:

Budgeting Strategies for Families in Times of Crisis

How to use data intelligence to optimize financial management

Best websites and blogs to follow financial trends in the USA

How Global Crises Affect the Financial Market in the USA

How to Create a Financial Plan to Expand Your Business in the USA

How to Monitor Financial Market Trends and Make Strategic Decisions in the USA

James Carter is a financial writer and advisor with expertise in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, James offers practical insight and analysis. His goal is to give readers the knowledge they need to achieve financial success.